AbraSilver has entered into option agreements to acquire an interest in the La Coipita project, located in the mining-friendly San Juan province, Argentina. The project is located in the prolific Miocene porphyry-epithermal belt and hosts multiple porphyry copper-gold targets.

Proposed Earn-In Option & Joint Venture Agreement With Teck Resources

On January 22, 2024, AbraSilver announced it had executed a definitive option and joint venture agreement (the “Agreement”) with a subsidiary of Teck Resources Limited (“Teck”), to explore and develop the La Coipita copper-gold project in San Juan, Argentina

Key Terms of the Transaction:

The Agreement grants Teck an option (the “Option”) to acquire an 80% interest in the Project, which it may exercise by:

- Making the following payments to or equity placement in AbraSilver:

- Initial mandatory cash payment of US$500,000;

- On or before January 31, 2025, a cash payment of US$1,000,000 or at Teck’s election, subscription for US$1,000,000 of common shares of AbraSilver (“ABRA Shares”) to be priced at the greater of (a) a 25% premium to the preceding 20-day volume weighted average price on the ABRA Shares on the TSX Venture Exchange, or (b) C$0.35 per ABRA Share; and

- On or before January 31, 2028, a cash payment of US$1,500,000.

- Incurring an aggregate of US$20,000,000 in exploration expenditures on the Project over a five-year period; and

- Making up to US$6,300,000 in optional cash payments in respect of amounts payable to the underlying Project vendors.

Upon exercise of the Option, the parties will incorporate a company in Argentina (“Newco”) to become the titleholder of the Project. Teck will hold 80% of Newco’s outstanding shares, with AbraSilver holding the remaining 20%. Each party will fund its pro-rata share of future expenditures on the Project through equity contributions to Newco or incur dilution in Newco. If a party’s shareholding interest in Newco is diluted below 10% or pursuant to certain other conditions of the Option Agreement, its shareholding interest will be converted to a 1.1% net smelter returns royalty on the Project, of which 0.6% can be bought back by the payor for a cash payment of US$3,000,000 at any time.

The La Coipita Project

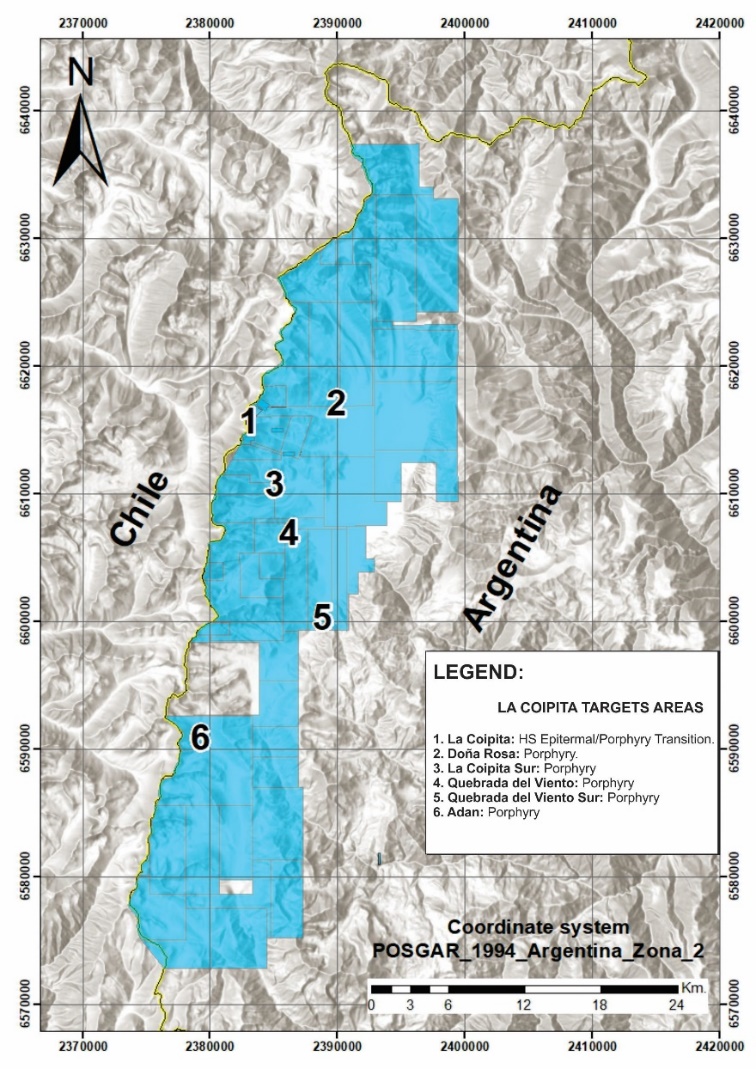

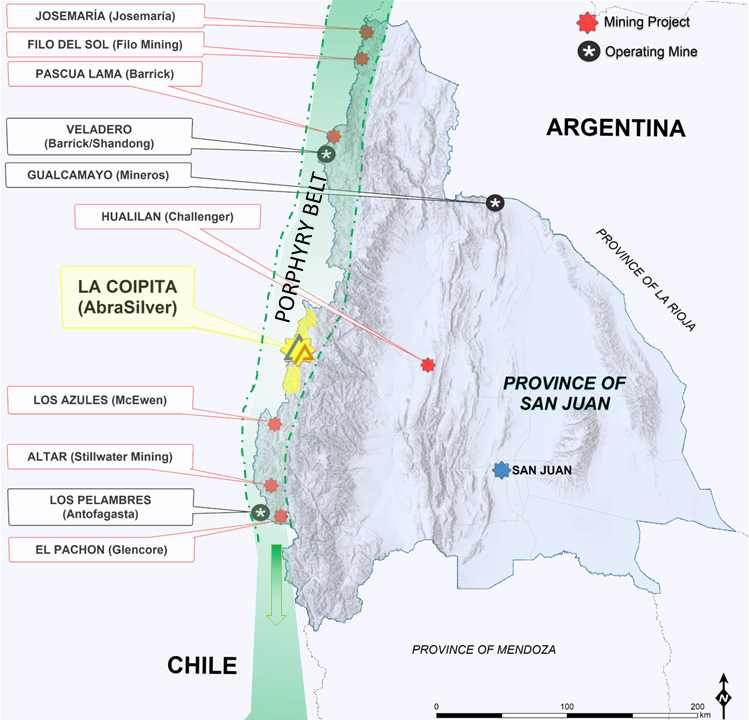

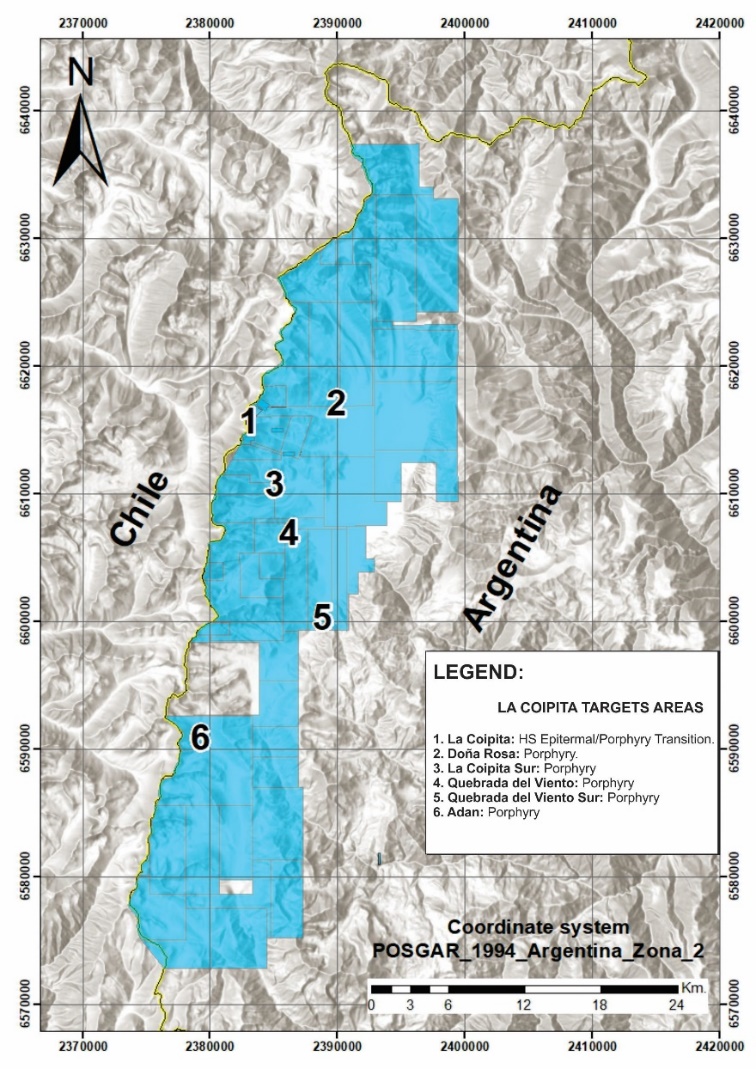

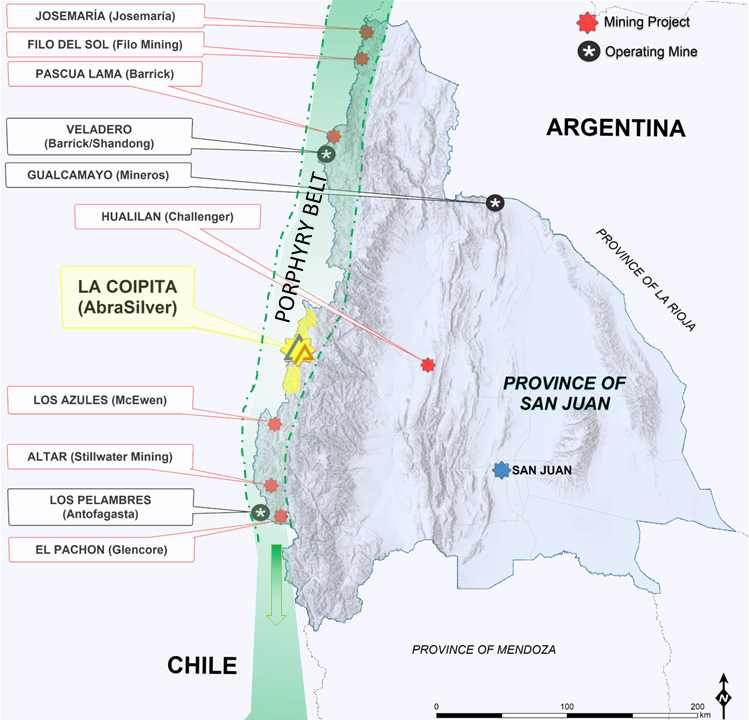

The La Coipita project is a district scale property consisting of over 70,000 hectares in the western portion of Calingasta Department, located in the mining-friendly San Juan Province of Argentina, adjacent to the Chilean border. Access to the area is via Calingasta, the nearest town, along 125 km of unpaved road to the Los Azules Cu-Mo porphyry project and then north along a dirt road to the La Coipita Cu-Au project. Elevation across the property ranges between 3,500 and 4,500 MASL with moderate to high relief.

The Project lies within the Miocene porphyry-epithermal belt of Argentina and Chile. During the mid-Miocene, the area developed an active magmatic arc, on its western side and a back-arc extensional environment to the east. Contemporaneous with the deposition of volcanic/volcaniclastic rocks was the emplacement of porphyry Cu-Mo-Au and/or epithermal Au-Ag (Cu) systems (e.g. Filo del Sol high-sulphidation epithermal Cu-Au-Ag deposit with Cu-Au porphyry, Los Pelambres/El Pachón Cu-Mo porphyry, Los Azules Cu-Au-Mo porphyry, El Indio/Veladero/Pascua Lama high-sulphidation epithermal Au cluster).

Numerous target areas have been identified at La Coipita. These target areas have coincident geophysical, geological and geochemical features that are consistent with copper-gold mineralized porphyry-type intrusions, either beneath high-sulphidation systems or in structurally uplifted areas. To date, drilling has only been conducted on the La Coipita target, where the initial results have identified the potential for a major Cu-Au-Mo porphyry system. Significant exploration upside potential is believed to exist at the La Coipita target & across multiple other promising regional targets (as shown in the Figure below).

La Coipita Location Map

La Coipita Regional Exploration Target Areas