Toronto - October 28, 2021: AbraSilver Resource Corp. (TSX.V:ABRA; OTCQX: ABBRF) ("AbraSilver" or the “Company”) is pleased to announce an expansion of the ongoing Phase II drill program, on its wholly-owned Diablillos property in Salta Province, Argentina.

The expanded Phase II drill program will consist of approximately 20,000 meters of diamond drilling with two drill rigs and is designed to further expand the existing Mineral Resources. To date, the Company has completed approximately 7,400 meters of drilling (in 33 holes) as part of the Phase II program. The expanded program is targeted to be completed in the first half of 2022 and anticipated to be followed by another updated Mineral Resource estimate on the Diablillos project during the second half of 2022.

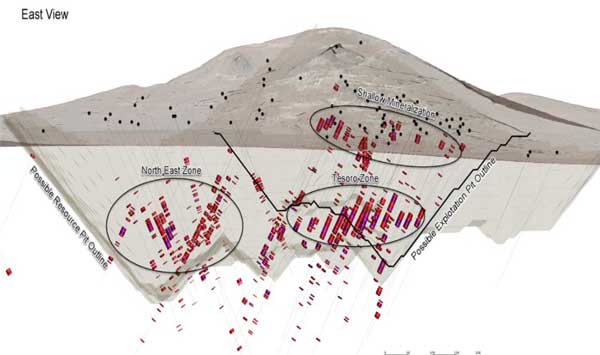

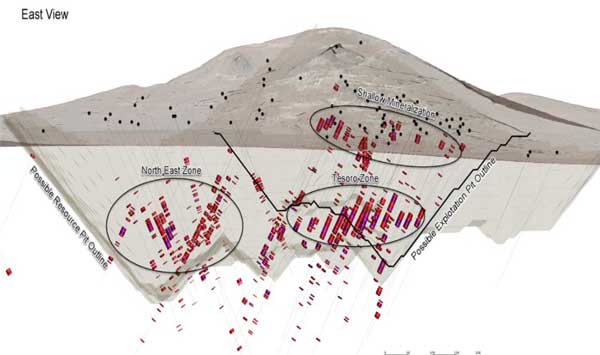

The main objectives of the expanded Phase II drill program are listed below (see Figure 1):

- Northeast Zone: Drill step-out holes targeting high-grade gold dominant mineralization in the Northeast Zone, which is expected to expand the dimensions of the proposed open pit and form the basis for a potential underground Mineral Resource in this zone.

- Tesoro Zone: Carry out close-spaced drilling in the high-grade silver and gold Tesoro Zone which is expected to convert existing Indicated Mineral Resources to the Measured category.

- Shallow Mineralization: Continue to expand shallow Mineral Resources within the existing open pit margin which is expected to further reduce the strip ratio and associated capital cost, as well as boost the production profile in the initial years of the mine plan.

John Miniotis, President and CEO, commented, “Our ongoing exploration program is continuing to provide us with outstanding results, confirming the excellent upside potential at Diablillos. This is a very exciting time for the Company, as we continue to focus on expanding the size of the Mineral Resource while advancing the project towards a construction decision.”

Figure 1 – Phase II Priority Targets

Discussion of Expanded Phase II Drill Program

The initial Phase II drill program was planned for 10,000 meters (approximately 40-45 holes) and commenced in May 2021. To date, assay results from 29 holes have been received in which multiple high-grade intercepts have been reported (see Table 1 below). Based on these highly encouraging results, the Company is doubling the Phase II program to 20,000 meters, which is expected to have a total cost of approximately US$6.5 million. The Company remains very well-funded with a current cash balance of over CAD$20 million.

Table 1: Diablillos Project – Highlights of Phase II Intercepts Announced To Date

| Drill Hole |

|

From

(m) |

To

(m) |

Type |

Interval

(m) |

Ag

g/t |

Au

g/t |

Cu

% |

AgEq

g/t |

AuEq

g/t |

| DDH-21-022 |

|

192 |

245 |

Oxides |

53.0 |

33.3 |

2.49 |

- |

220.5 |

2.93 |

| DDH-21-038 |

|

112 |

221.3 |

Oxides |

109.3 |

176.8 |

1.53 |

- |

291.6 |

3.89 |

| |

Including |

182.8 |

208.5 |

Oxides |

25.7 |

125.0 |

5.20 |

- |

515.0 |

6.87 |

| DDH-21-039 |

|

194 |

215 |

Oxides |

21.0 |

50.6 |

5.30 |

- |

448.1 |

5.97 |

| DDH-21-045 |

|

108 |

172.5 |

Oxides |

64.5 |

125.6 |

0.61 |

- |

171.4 |

2.28 |

| DDH-21-046 |

|

84.5 |

124 |

Oxides |

39.5 |

200.5 |

0.45 |

- |

234.3 |

3.12 |

| |

Including |

106 |

112 |

Oxides |

6.0 |

709.0 |

1.14 |

- |

794.5 |

10.59 |

| DDH-21-048 |

|

42.5 |

85.5 |

Oxides |

43.0 |

76.7 |

1.07 |

- |

157.0 |

2.09 |

Refer to Technical Notes below for additional information.

Several Near-Term Milestones

Looking ahead, the Company remains on track to deliver several important milestones over the coming months, including:

- Updated PEA study: The updated PEA study continues to progress well and remains on track to be completed in November. The study is being led by Mining Plus, an industry leading mining technical services provider, with input from specialists across all key mining disciplines.

- Drill Results: Ongoing drill results from the expanded Phase II program are expected to be announced on a consistent basis through mid-2022.

- Optimization and Trade-Off Studies: Following the completion of the updated PEA study, the Company plans to initiate engineering activities and commence a number of trade-off and optimization studies designed to continue to further enhance the economics of the project.

- Other Projects:

- Arcas Project, Chile – Our partner, Rio Tinto has completed the initial 2,000-meter drill program at Arcas. Assay results will be announced once received.

- La Coipita Project, Argentina – The Company plans to commence an initial drill program at La Coipita prior to year-end. The initial program is expected to consist of approximately 3,000 meters (in 7-8 holes).

About Diablillos

The 80 km2 Diablillos property is located in the Argentine Puna region - the southern extension of the Altiplano of southern Peru, Bolivia, and northern Chile - and was acquired from SSR Mining Inc. by the Company in 2016. There are several known mineral zones on the Diablillos property, with the Oculto zone being the most advanced with approximately 90,000 meters drilled to date. Oculto is a high-sulphidation epithermal silver-gold deposit derived from remnant hot springs activity following Tertiarty-age local magmatic and volcanic activity. Comparatively nearby examples of high sulphidation epithermal deposits include: Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina).

Table 3 – September 8, 2021 Mineral Resource Estimate for the Oculto Deposit, Diablillos Project

| Category |

Tonnage

(000 t) |

Ag

(g/t) |

Au

(g/t) |

Contained Ag

(000 oz Ag) |

Contained Au

(000 oz Au) |

| Measured |

8,235 |

124 |

0.98 |

32,701 |

259 |

| Indicated |

32,958 |

54 |

0.70 |

57,464 |

744 |

| Measured & Indicated |

41,193 |

68 |

0.76 |

90,165 |

1,002 |

| Inferred |

2,884 |

34 |

0.7 |

3,181 |

66 |

Effective September 8, 2021. Full details of the Mineral Resources are available in a Company news release dated September 15, 2021. A Technical Report, which is being prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) by Mining Plus, will be available on SEDAR (www.sedar.com) under the Company’s issuer profile within 45 days of the news release dated September 15, 2021. The Mineral Resource estimate is NI 43-101 compliant.

Technical Notes

All results in this news release are rounded. Assays are uncut and undiluted. Intervals are drilled widths, not true widths. AgEq calculations for reported drill results are based on USD $20.00/oz Ag, $1,500/oz Au and $3.00/lb Cu. The calculations assume 100% metallurgical recovery and are indicative of gross in-situ metal value at the indicated metal prices. No metallurgical testwork has yet been completed on the recovery of copper.

Qualified Persons

David O’Connor P.Geo., Chief Geologist for AbraSilver, is the Qualified Person as defined by NI 43-101, has reviewed and approved the scientific and technical information in this news release.

About AbraSilver

AbraSilver is a well-funded silver-gold focused advanced-stage exploration company. The Company is rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina, which has a Measured and Indicated Mineral Resource base of over 160Moz on a silver-equivalent basis or 2.3Moz on a gold-equivalent basis. The Company is led by an experienced management team and has long-term supportive shareholders including Mr. Eric Sprott and SSR Mining. In addition, AbraSilver owns a portfolio of earlier-stage copper-gold projects, including the Arcas project in Chile where Rio Tinto has an option to earn up to a 75% interest by funding up to US$25 million in exploration. AbraSilver is listed on the TSX-V under the symbol “ABRA” and in the U.S. under the symbol “ABBRF”.

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on Twitter at www.twitter.com/abrasilver

Alternatively please contact:

John Miniotis, President and CEO

[email protected]

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

The Diablillos Mineral Resource estimate is NI 43-101 compliant. Full details of the Mineral Resources are available in a Company news release dated September 15, 2021. The full technical report, which is being prepared by Mining Plus in accordance with NI 43-101 standards, will be available on SEDAR (www.sedar.com) under the Company’s issuer profile within 45 days of the news release dated September 15, 2021.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release